Launch. Scale. Lead.

The financial services world moves fast - but licenses, integrations, and compliance can drag you down.

Why spend years navigating complexity when you could be in-market within months?

With OMNEA, you unlock:

-

Instant access to financial infrastructure with no need to build from scratch

-

Pre-integrated banks & service providers providing connections at your fingertips

-

Compliance covered to simplify regulatory obstacles

-

Speed to market allowing you to focus on innovation, not administration

Don’t get stuck in the queue.

OMNEA is your launchpad to financial innovation.

Our Infrastructure

Direct Payment Infrastructure Without Traditional Dependencies

Most fintechs today rely on bank sponsorships or limited payment rails. Omnea PaaS is fully aligned with SARB's Payments Ecosystem Modernisation (PEM) Programme and activity-based licensing framework, enabling non-banks to participate in the National Payment System without fragile sponsor-bank dependencies — providing the live and compliant path to PEM.

What you get today: Full payment processing, regulatory compliance, custody services, and real-time settlement — all the capabilities you'd expect from direct central bank access. When SARB opens direct access in 2026, you'll seamlessly upgrade to even deeper integration.

No More Bank Dependencies

Skip the traditional bank sponsorship model. Launch your fintech with full payment infrastructure, compliance, and settlement capabilities through Omnea's proven CORTEX-powered platform.

.png)

10 clients live and operational

20+ integrations with banks, PSPs, VAS providers

Collateral‑backed payments with real‑time, final settlement inside administered accounts.

Full compliance & custody services facilitated via licensed administered accounts; Omnea does not hold customer funds.

Proven track record with millions of transactions

Proven at Scale

Our infrastructure isn't theoretical – it's processing real payments, managing real compliance, and serving real customers across multiple sectors every day.

Shared Infrastructure Model

PaaS services run on our proven shared infrastructure. Need your own dedicated instance of CORTEX and integrations? Let's talk.

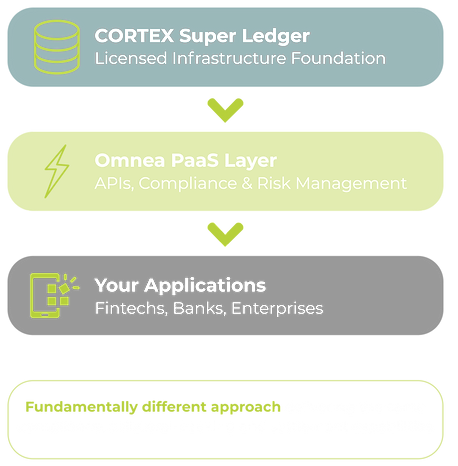

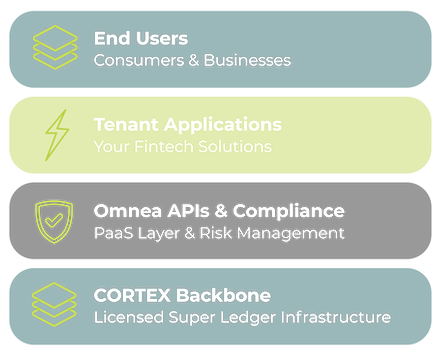

Layered Architecture

While others promise future solutions, Omnea delivers proven infrastructure today.

The Omnea Advantage

Who We Serve

From emerging fintechs to established enterprises, Omnea powers diverse embedded finance use cases.

What You Can Offer Your Customers

With this solution, tenants can offer their customers accounts, in their own names with multiple payment acceptance, payment disbursement and VAS services - even offer interest on positive balances if they wanted to.

Whatever your idea, we can help you.

*Administered accounts refers to accounts held and managed by licensed administrative FSPs or nominees. Omnea provides the integration and automation layer but does not hold or operate customer funds.

Real-World Use Cases

Micro-Lender Ecosystem

A micro-lender disburses into its own ecosystem account, enabling repayment reminders, insurance upsells, and merchant cashback offers.

Key Benefits

-

Increased customer engagement

-

Insurance product upsells

-

Transaction fee revenue

Payment Acquirer Account

A payment acquirer settles into its own merchant account, allowing merchants to pay suppliers, staff, or taxes from the same account.

Key Benefits

-

Transaction fees on every flow

-

Supplier payment revenue

-

Enhanced merchant stickiness

Retail Credit Ecosystem

A retailer with a credit book disburses store credit into a closed-loop account, ensuring spend stays in their ecosystem.

Key Benefits

-

100% spend retention

-

Cross-product opportunities

-

Enhanced customer loyalty

See how forward-thinking organizations are using Omnea to retain control of funds and unlock new revenue streams.